Ratings Methodology

SQM's rating methodology incorporates a wide range of research elements that generally require

up to approximately three months for completion. These elements include:

- Detailed SQM Review Questionnaire, probing key areas including Business Profile, Investment

Process and Performance, Fees, Key Staff, Governance and Risk

- Comprehensive SQM Data Template covering a wide variety of key Fund positioning and

portfolio criteria

- Review of official documents such as PDS, Fund Constitution, FSC, statutory financial

statements, and any other documents necessary to the rating process

- In-depth meeting conducted with key people in the investment management team and relevant

business-side executives (e.g. CEO, Head of Distribution)

- Quantitative analysis conducted via the SQM Investment Dashboard, a proprietary web-based

system developed internally to assess important Fund metrics

The assessment incorporates a combination of qualitative and quantitative research techniques

to determine rating opinions on domestic and global products in the following categories:

Alternatives, Fixed Income, Equities, Infrastructure, A-REITs, G-REITs, Direct Property,

Mortgage Trusts, RMBS, ETFs, SMAs.

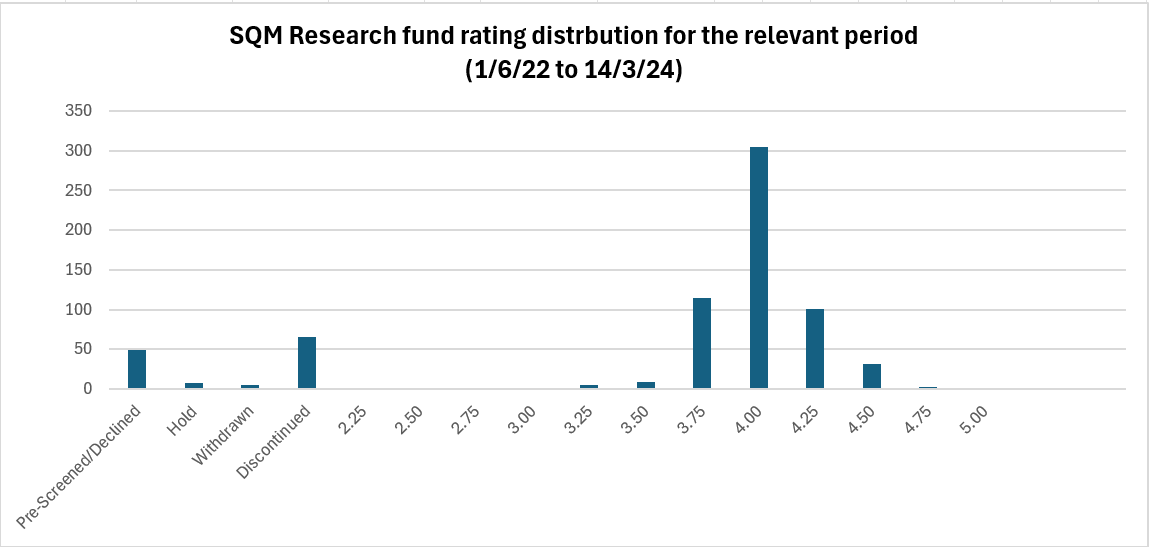

Information generated is passed through an assessment model at the completion of the research

process. The model generates a product score, which correlates to a specific star rating up to a

maximum of five stars. The star rating spectrum allows products to be ranked within quarter star

increments.

Following are descriptions for each of the star ratings, developed as a guide for dealer group

research teams and investment committees: